Press Release

2013 Business Spotlight

Creation of Economic Value

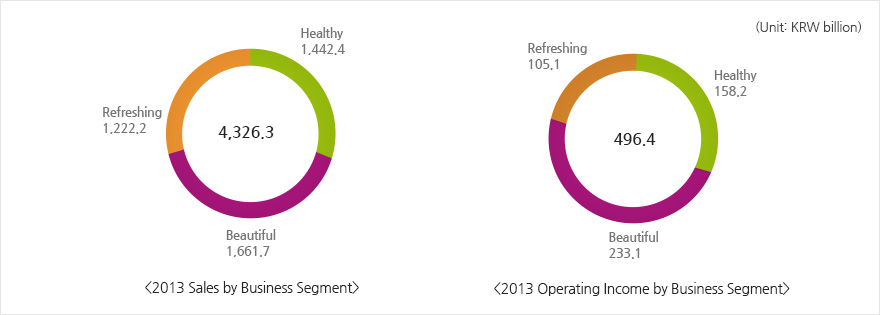

In spite of the hardships faced in both the domestic and overseas management environments, LG H&H has operated its business systematically, resulting in the stable operation of its three business portfolios: 'Healthy,' 'Beautiful,' and 'Refreshing.' In particular, we have strategically focused on our 'Beautiful' business segment, achieving visible business outcomes in the overseas as well as domestic markets.

-

2013 Business Status

Walking in step with the trend of consumption polarization in our 'Beautiful' market, we focused on both high- and low-priced cosmetics and enhanced our market leadership in each business segment. We also concentrated on channels with high growth potentials, like duty-free, online, and brand shops, as a preemptive move against channel diversification, which resulted in the achievement of higher growth in comparison with the current market tendency.

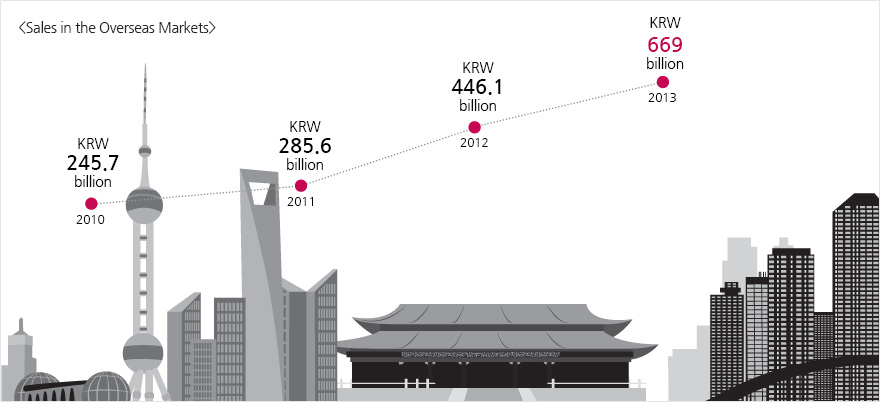

In our 'Healthy' business, we unveiled innovative products in hair, oral, and body care, whose market trends rapidly become premium and differentiated, so that we also obtained good results in this area. As for our 'Refreshing' business, the business continued to bear good fruit due to the growth of carbonated drinks with strong brand power, new-products release, and differentiated marketing. With these successful experiences as a stepping stone, we have made an attempt to extend our operation to the broader global market. We have extended our bases to the North American region, the world’s largest market, as well as to the Chinese, Japanese, and Southeast Asian regions. We have accelerated our business growth with these bases as the center. In 2013, the overseas sales of household goods and cosmetics reached around KRW669 billion, up more than 50% from the previous year. The proportion of sales also expanded to 15% in 2013 from 11% in 2012.

Meanwhile, the expansion of the overseas market has been accompanied by our continuous endeavor to secure a new growth engine for each business segment: strengthening the dietary supplement business in our 'Healthy' business, investing in a THEFACESHOP overseas base in our 'Beautiful' business, and preparing to produce functional beverage and dairy products in our 'Refreshing' business. These are combined with our unceasing efforts to selectively develop new businesses that are expected to create synergy with our existing businesses. In so doing, compared with 2012, our company’s sales has increased to KRW 4,326.3 billion, up by 11% and operating incomes increased to KRW 496.4 billion, up by 11.4%, respectively. -

Overseas Businesses

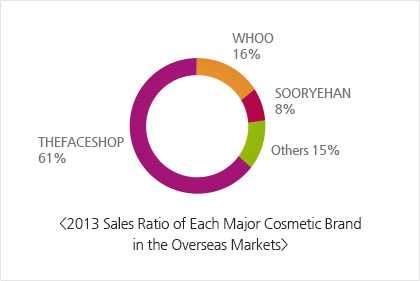

LG H&H is operating three production subsidiaries in China and Vietnam and one sales subsidiary each in China, USA, and Taiwan to carry out its household goods and cosmetics business. The company has exported major products to 22 countries, including the above-mentioned countries plus Russia, Iran, etc. Our cosmetics brand entered the Japanese market through Ginza Stefany, the Japanese cosmetics provider, which we acquired in 2012. In newly explored markets like Colombia, the sales generated by the exportation of goods like raw materials were up 10% from 2012. Our activity boundaries in the overseas markets have been enlarged in a sustained manner. Our strategically focused cosmetics brand is ‘Whoo’, which is being advertised in the local market to enhance its brand awareness. The first shop was launched in a premium department store in Hong Kong in 2013, receiving positive responses from the customers. As for BELIF, it was first launched in Singapore with the natural-herb concept, and after that, we made every effort to open a brand shop and to enter a department store in Indonesia, Taiwan, and others. BEYOND provides good-quality products at low prices and with its cute animal shape and the spirit of anti-animal testing, the brand is expected to appeal to the overseas consumers as the representative brand in the low and middle-priced markets. THEFACESHOP, recognized as a practical and low/middle-priced brand in the home market, has a differentiated positioning strategy for each nation.

In 2013, THEFACESHOP established a subsidiary in China and Singapore, where an exclusive operation system had been used, to gain a foothold for business expansion in such countries. Additional launching of other brands, such as belief and VDL, has been being done since the founding of the Singapore subsidiary in April 2013. In September, a joint venture was established in Guangzhou, China and the acquisition of exclusive sales entities was completed, equipped with a direct management system to develop various business activities. In Canada, the management systems of three F&P shops taken over in July 2013 was changed into the direct control system, which leads to big achievements. The number of directly controlled shops will continue to grow for business expansion in Canada.

In terms of household goods, we have focused on raising oral and detergent brands. We have finished our entry into strategic- focus regions, including western Russia, Ukraine, and Kazakhstan, with the oral care brand PERIOE and are tightening marketing activities. We have concentrated on selling quality products to the consumers in Russia and Columbia, with the enriched detergent brand TECH. In Japan, the fabric softener brand Saffron has expanded its detergent product range, unveiling new products as a result of product renewal tuned to consumer needs. To improve the brand awareness, we plan to develop branding campaigns for large channels and customized promotions for small channels. In the local subsidiaries in China, Vietnam, and Taiwan, the number of local employees will continue to increase in an attempt to enhance customer satisfaction through a rapid and detailed grasp of the local consumers’ needs and its application to our products. Furthermore, considering the geographic conditions of the competitive local suppliers with quality subsidiary materials and competitive production costs, the ratio of local purchase has grown continually, accounting for 72% in 2013 (excluding THEFACESHOP).

-

Japanese Market

In 2012, our company entered the Japanese market in full scale by acquiring Ginza Stefany, the mail order cosmetics business in Japan. While cosmetics companies, including foreign corporations which had carried out their business mainly through department stores, are expected to reinforce the WEB sales channel, Ginza Stephany has recruited new customers while systematically caring for its existing customers, enlarging the people’s awareness of Ginza Stephany and its branding image exposures to consolidate the cosmetics sales. In 2013, the acquisition of EVERLIFE, the premium health functional food company, followed in a bid to expand the business scale of health functional foods. Using the premium branding image of EVERLIFE, we plan to enter Taiwan and China. As for household goods, our major fabric softener/detergent brand has been distributed through our agency in Japan and has aggressively knocked on the doors of previously unreached distribution channels to expand its market coverage.

-

Chinese Market

For the last five years, the Chinese cosmetics market has experienced average 15% continuous growth annually, and especially, the premium cosmetics sales have been expanded in a sustained manner. In accordance with this market growth trend, we have focused on cosmetics distribution in the premium market, including department stores. Shop opening targeting prestige department stores with high potentials located in major cities has been pursued to enhance the premium image through the new shop interior added to the existing interior operated in South Korea. Unlike the drastically growing cosmetics market, the growth rate of the household market in the last few years has decreased to around 6% from approximately 10% due to the global economic recession.

In view of the economic growth in China, however, the purchase rate of household items in small and medium-sized cities has been gradually rising, and many multinational competitors leading the household market are moving from big cities to small and medium-sized cities. In addition, with the continual sales expansion of online distribution, LG H&H currently invests more in online sales than in offline sales.

THEFACESHOP has experienced rapid growth in the Chinese market for three years, recording a 21.5% average annual growth rate. Thanks to the establishment of a subsidiary in Shanghai, China, the company entered the online market successfully, and in 2013, the offline business operated as two exclusive entities was taken over by the newly founded Guangzhou subsidiary, which is expected to enable both the online and offline businesses to expand into an integrated system controlled by the head office. As for our online business, we plan to increase its market share by actively advancing into the new online home shopping channel in addition tothe existing Internet business. As for our offline business, we aim to aggressively expand our business capacity by renewing the existing shops acquired through joint venture establishment. Furthermore, for both our online and offline channels, we plan to equalize the product prices, secure the same VMD(Visual Merchandising) images, and come up with a manual containing the sales method, pursuing the strategic reinforcement of the company’s global brand image.