TV CF

Coca-cola, Coke time

Date 2018.07.24

LG H&H, Reports Record High 2Q Results

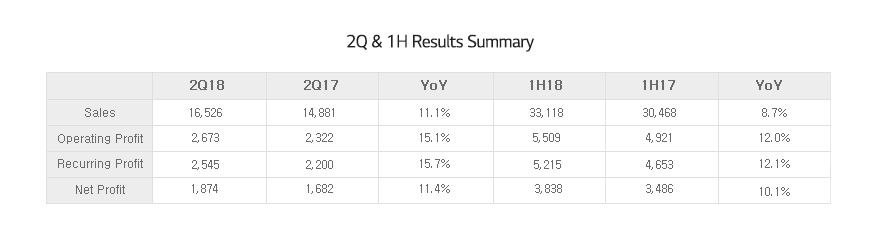

Sales 1.7tr won (+11.1% yoy), Operating Profit 267bn won (+15.1% yoy)

July 24, 2018 – In 2Q 2018, LG Household & Health Care, Ltd. (CEO: Suk Cha) delivered sales of 1.7tn won (+11.1% yoy), operating profit of 267bn won (+15.1% yoy), and net profit of 187bn won (+11.4% yoy). In 1H 2018, total company sales increased to 3.3tn won (+8.7% yoy), operating profit increased to 551bn won (+12.0% yoy), and net profit increased to 384bn won (+10.1%). Despite sluggish domestic demand and slow recovery in number of inbound tourists, the company delivered the highest 2Q and 1H result of all times.

Sales has increased for fifty-one quarters since 3Q 2005, and operating profit has increased for fifty-three quarters since 1Q 2005, delivering continuous growth for more than thirteen years. Debt-to-equity ratio improved by 11.2%p yoy to 48.4% due to increased cash flow from profit growth.

In 2Q 2018, Beautiful (Cosmetics) sales increased 23.2% yoy to 953bn won, and operating profit increased 30.1% yoy to 194bn won. Although number of new entrants into domestic and Chinese cosmetics market is increasing massively, Beautiful delivered strong growth from success of luxury brands with well established brand propositions.

Since sales surpassed 1tn won for the first time in 2016, ‘Whoo’ set a new record again as its sales surpassed 1tn won in July and the length of time to reach the level shortened every year. To meet rising market demand for luxury cosmetics, the company’s luxury brands including ‘su:m’ and ‘OHUI’ strengthened competitiveness by further focusing on differentiated high-end lines.

In 1H 2018, Beautiful sales increased 17.4% yoy to 1.9tn won, and operating profit increased 24.7% yoy to 406bn won.

In 2Q 2018, Healthy (Household Goods) sales decreased 6.0% yoy to 337bn won, and operating profit decreased 27.7% yoy to 27bn won. The company continued to simplify premium-focused business structure in order to enhance core capabilities for mid-to-long term growth rather than focusing on short term growth. While sales and operating profit decreased due to reduction of channel inventory and SKU optimization, business structure has become less complex and more transparent.

In 1H 2018, Healthy sales decreased 5.2% yoy to 732bn won, and operating profit decreased 25.4% yoy to 69bn won.

In 2Q 2018, Refreshing (Beverges) sales increased 1.8% yoy to 362bn won, and operating profit increased 1.3% yoy to 46bn won. Domestic market share expanded 0.9%p to 30.5%. Carbonated Drinks sales increased 3% yoy from fast growth of ‘Coca-Cola’, ‘Sprite’, and ‘Monster Energy’. Non-Carbonated Drinks sales increased 2% yoy as ‘Geogia’, ‘Crushed Pear Juice’, and ‘Toreta’ delivered high growth.

In 1H 2018, Refreshing sales increased 3.6% yoy to 679bn won, and operating profit increased 2.7% yoy to 75bn won.